Integrating with payment gateways: How to choose the most suitable one for your application

Does the payment gateway support seamless integration with your app?

When choosing a payment gateway for your app, ease of integration with your software systems is a crucial factor. Many apps fail to provide a convenient payment experience due to complex connectivity issues or technical compatibility issues between the gateway and the app.

The most important thing to look for here is flexible and clear APIs. Some payment gateways offer comprehensive development tools and responsive technical support, making it easy for developers to seamlessly integrate them into apps. This reduces time and technical costs.

Are you using an app built with Flutter or React Native? You should ensure that the payment gateway provides ready-made libraries for these technologies. Gateways that don't support your technologies may require custom solutions, which increases costs and increases potential errors.

Also, it's essential to fully test the integration in a sandbox. Most professional payment gateways provide a testing environment where you can test virtual transactions before the gateway actually goes live. This allows you to detect potential issues before the actual user accesses it.

Supporting Local and International Currencies… The Key to Reaching Larger Stakeholders

One of the most important factors when choosing a payment gateway is its currency support. A payment gateway that only supports one currency may limit your expansion and prevent you from entering new markets.

If your app targets only the local market, it's essential to choose a gateway that directly supports the local currency. Paying in Egyptian pounds or Saudi riyals, for example, without additional conversions, increases the ease of purchase and removes user psychological barriers.

If your app serves an international audience, you need a gateway that supports multiple currencies and automatically converts prices. Gateways like PayPal and Stripe offer this, making the user experience seamless regardless of their currency.

Make sure the gateway displays in-app prices in the user's currency, so they won't be surprised by a conversion upon reaching the payment page. This small detail directly impacts your completion rate and reduces dropouts before payment.

Also, pay attention to currency conversion fees. Some gateways impose high fees that impact your profits or make the final price higher than expected, which can lead to user churn.

Collection Speed: Are your earnings arriving on time?

One factor many app owners overlook when choosing a payment gateway is the speed of the money transfer from the gateway to your bank account. This may seem like a simple detail, but it directly impacts your cash flow and business continuity.

Some payment gateways process payments within 24 to 48 hours, while others may take a week or more. This time difference is especially important if you need daily cash flow to manage your operations, such as paying suppliers or employees.

Be sure to check each gateway's collection policy: How long does it take? Is the transfer automatic or manual? Are there specific days for transfers? These small details can hinder the stability of your cash flow.

Also, make sure the payment gateway doesn't impose additional fees on bank transfers or withdrawals. Some gateways may charge a fixed or variable percentage for each transfer, which reduces your net profit.

Some gateways offer flexible options such as daily, weekly, or monthly transfers, depending on your preference. This flexibility is useful if you manage more than one project or want to schedule payments to suit your financial style.

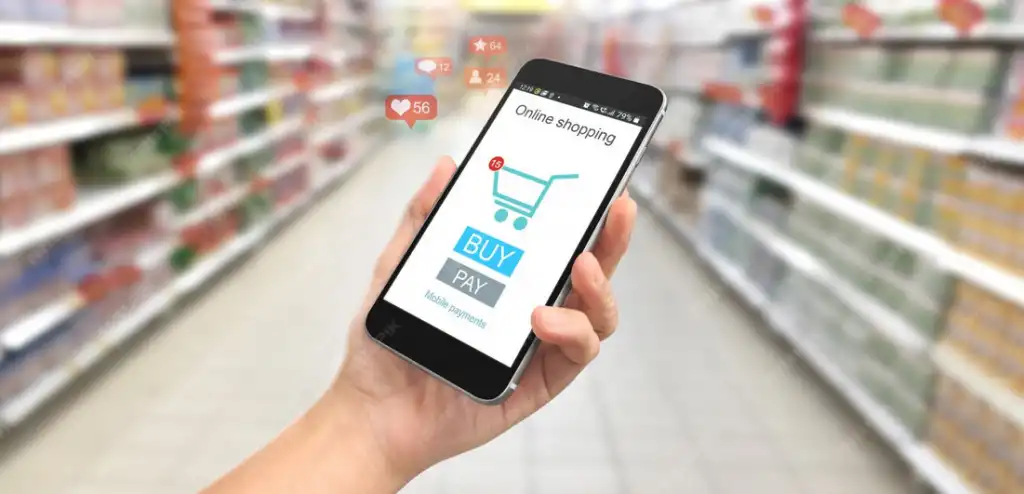

User experience during checkout: Is it smooth or complicated?

It's not enough for a payment gateway to be robust internally; it must also offer a simple and fast user experience. Complicated payment steps or multiple windows can lead to user abandonment.

Choose a gateway that offers a responsive and fast-loading payment interface, especially on mobile, where the majority of transactions take place. A slow or poorly rendered checkout page can cost you a lot of potential transactions.

Also, make sure the gateway supports autofill for card information and saved payment methods such as Apple Pay or Google Pay. These features reduce time and significantly increase the likelihood of completion.

Some gateways open the payment page in an external window, while others are fully integrated within the app. Internal integration provides a smoother experience and makes users feel like everything is happening within your app, not with a third party.

Also, make sure the payment interface supports the appropriate language for users. If it's only in a foreign language, users may feel insecure or confused while entering sensitive information.