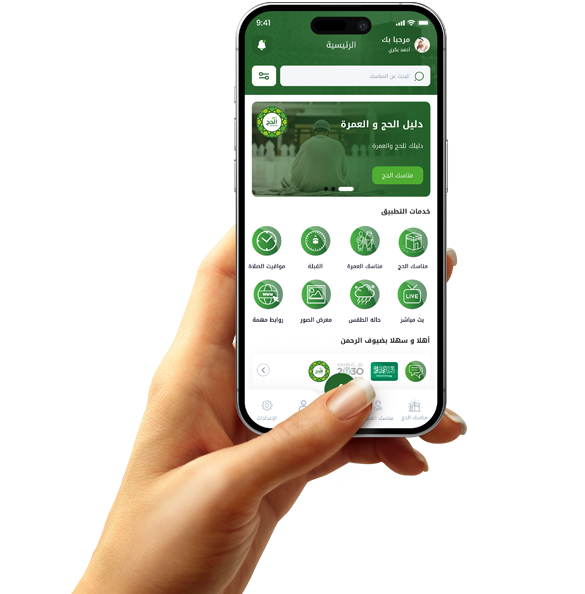

Personal expense management application design

How do you design an expense app that changes users' financial behavior for the better?

Most people don't realize how quickly their monthly income depletes. This is where an expense management app comes in as a way to change this behavior through tracking and analysis.

However, the success of an app depends not only on recording numbers, but also on how they are presented and explained in a simple way that motivates the user to follow them daily.

The first step in design should focus on the user experience, such as a welcome screen that explains the benefits of expense tracking and invites the user to enter their first financial transaction.

Ease of use is essential; therefore, all transactions should be able to be executed within seconds, without complicated steps or tedious entry.

It is preferable for the home screen to include a quick overview of the most important figures: daily expenses, remaining budget balance, and alerts, if any.

The simpler the information is visualized, such as pie charts or bar charts, the more clearly the user can understand their financial situation.

It is crucial that the app allows for adding notes for each financial transaction, such as "dinner with friends" or "school books," to understand spending patterns.

A "non-recurring expense" category can also be added to distinguish unexpected expenses from the usual pattern, which aids in better analysis later.

Artificial intelligence can be used to suggest automatic categories based on description, amount, and location, making life easier for the user.

We also recognize the importance of reminder notifications for entering daily expenses, or alerts when the permitted spending limit is approaching.

A single interface eliminates the need for a ledger: A simple design for your daily expenses

In the past, a small notebook or a paper spreadsheet was the way people kept track of their expenses. Today, this notebook has been transformed into a smart phone app.

The design of this type of app should mimic the ease of pen and paper, but with far superior analytical capabilities and intelligence.

The main interface should be presented simply: a box for entering expenses, their type, and frequency, with the ability to save recurring expenses with a single click.

The goal isn't to have a large number of features, but rather to reduce steps to achieve the greatest benefit with the least effort.

A shortcut bar at the top displays the daily expenses and the remaining balance of the daily budget, helping keep the user on track.

Also, the categorization feature helps understand spending patterns, such as food, shopping, transportation, entertainment, and others.

It would be ideal if the app could automatically identify categories using intelligent algorithms to reduce duplication for the user.

Adding an "expense log" feature could be presented as a chronologically organized list, making it easy to retrieve any previous expenses.

When you click on any transaction, its exact details should appear: date, category, notes, and even the geographic location, if applicable. Enabling the user to search within the record by keywords, numbers, or categories gives the user complete control over their financial data.

Smart Expenses App: When Your Phone Turns into Your Personal Financial Manager

With the fast-paced lives and numerous commitments, many people find it difficult to accurately track their expenses. Therefore, designing a smart expenses app offers a practical and effective solution.

The idea of the app is not just to record spending, but to enable the user to clearly and realistically see the full picture of their financial situation.

The first thing the designer should consider is making the app simple from the first screen, welcoming the user with easy setup steps, such as specifying monthly income and financial goals.

The user journey then begins with the expense recording screen, which should be quick, interactive, and require no more than three clicks.

An expense can be attached with a receipt image or the location of the expenditure, adding useful details that enrich the experience.

Because time is of the essence, it's best for the app to recognize the user's behavior and suggest categories or values based on previous usage.

A pie chart that divides expenses by category helps visually understand spending patterns and makes financial analysis more enjoyable.

The feature of setting a budget for each category, such as "300 pounds for food" and "150 pounds for transportation," enables the user to accurately monitor each item.

A successful app alerts the user before they exceed the budget limit, not after it's too late.

The daily reminder to enter expenses also motivates the user to commit and follow through without forgetting or becoming lazy.

Control Your Money with a Touch: Steps to Designing a Fast and Effective Expenses App

Many users abandon expense apps a few days after downloading them, not because they're useless, but because they're slow or complicated.

Therefore, the first secret to designing a successful expense management app is speed and simplicity. Financial transactions are recorded within seconds.

The app should open to a straightforward screen displaying "Add Your Expenses Now," without ads, introductions, or tedious steps.

It's preferable to have a large, clear button in the center of the screen to record expenses, with quick entry including only the amount, category, and note.

Each field should be intelligent; the amount should be entered in numbers only, and the category should be chosen from a list of easy-to-understand visual icons.

The app can learn from the user, automatically suggesting a "Restaurants" category if the user enters "Pizza" in the note, for example.

When you press "Done," the app should display a simple summary of the impact: How much did you spend today? How much is left in your weekly budget?

The user interface should feature a horizontal bar showing spending progress, with a color that gradually changes from green to red depending on the expenditure.

Voice input may also be useful for users who want to record expenses without touching the screen, especially while on the go.